The differences between unsubsidized and subsidized loans start from the interest accruement period. Is It Better to Pay Off Subsidized or Unsubsidized First 1 in 10 Students Carry College Debt 20 Years Later.

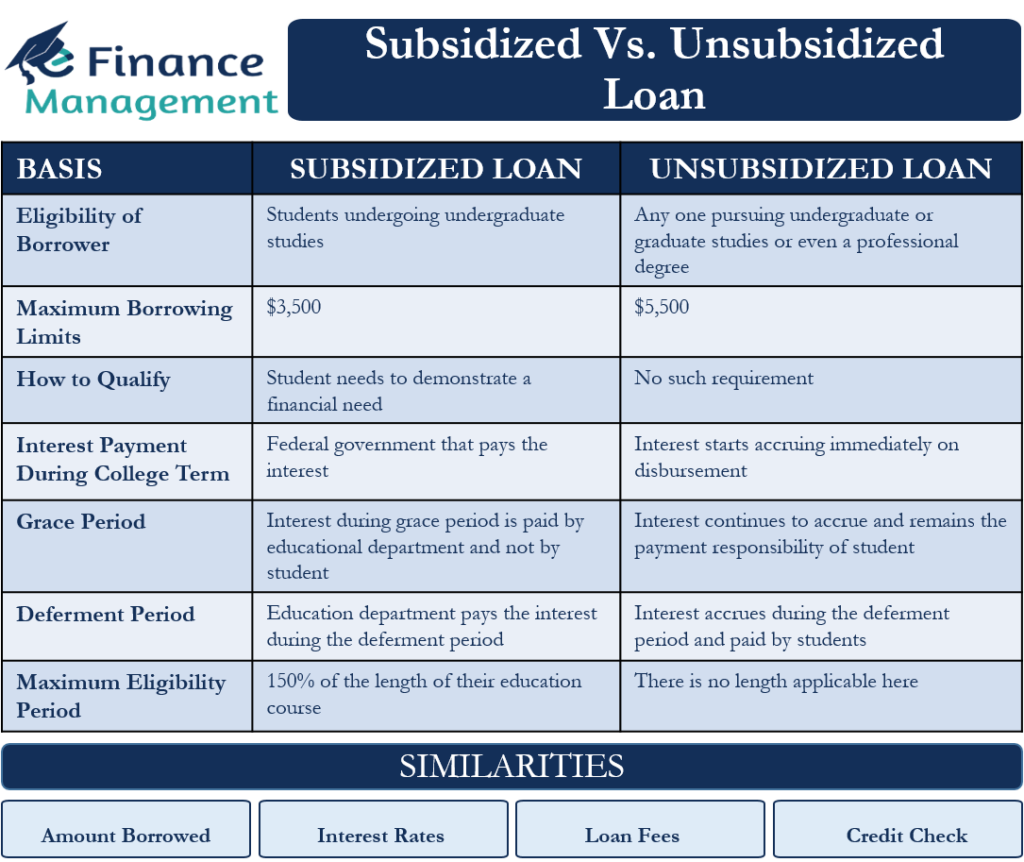

Subsidized Vs Unsubsidized Loan Differences And Similarities Efm

The government pays the interest on them while a student is in school and during the six-month grace period after graduation.

. On unsubsidized loans youll prevent the interest they charge while in school from capitalizing. The government pays interest for subsidized loans while you are in. Even with a combination of subsidized and unsubsidized loans it may not be enough to cover the full cost of college.

Im currently graduated but would I be better off paying unsubsidized first just incase I ever decided to pursue a masters. Both mean you pay less over the life of the loan. So if all else are equal you should prioritize unsubsidized loans first.

These loans should be used to their limit before taking any other type of student loan. The Cost of College. Again interest on unsubsidized loans is always accruing which means these student loans carry higher costs and therefore more financial risk.

Both loans have the same fee. Pay off unsubsidized loans with low interest rates. Repay unsubsidized loans first.

Subsidized student loans do not accrue interest while enrolled in college at least half-time or during deferment periods. If you can qualify for them youll pay less money in interest charges with a subsidized loan and youll. Loans are backed by.

For example you might pay down the highest rate unsubsidized loans first then highest rate. Your interest on subsidized loans should be zero when you begin repayment. If youre receiving an unsubsidized student loan your maximum loan amount is 5500 for the first year.

Fortunately the ED recognizes that and grants higher limits for independent students. The unsubsidized graduate degree loan interest rate is 430. When it comes to subsidized and unsubsidized loans subsidized loans are the clear winner.

Unsubsidized Loans Direct Unsubsidized Loans offered by the US. Once these are paid off move on to unsubsidized loans with lower interest rates. Unsubsidized student loans on the other hand charge interest during in-school deferment and grace periods.

It makes sense then to work on paying off these loans first. However you can borrow more money with unsubsidized loans. Also Im also paying the higher interest rate ones down first of course.

If you have federal student loans they may be either subsidized. Should You Pay Subsidized Or Unsubsidized First. A general rule of thumb is to either pay off your highest interest debt or focus on the smallest outstanding balances the snowball method first.

When an unsubsidized loan is accruing interest the amount of interest is added to the principal and youll have to pay interest on the increased principal amount this is called capitalization. If all else equal always pay unsubsidized first because the government will pay the interest on subsidized loans whole youre unemployed or going to school. The Difference Between Subsidized and Unsubsidized Student Loans.

When youre deciding which student loans to pay off first consider prioritizing your unsubsidized student loans over any subsidized loans. For independent students and those dependent on parents who do not qualify for federal PLUS loans the maximum amounts are 9500 and 33500 respectively. I know subsidized is when the interest doesnt accrue while in school.

Youre an Independent Undergrad. A subsidized loan doesnt start accruing interest until youve graduated and youre out of deferment. While these loans are not better than unsubsidized loans they offer borrowers a lower interest rate than unsubsidized loans.

If you have a mix of both unsubsidized loans and subsidized loans youll want to focus on paying off the unsubsidized loans with the highest interest rates first and then the subsidized loans with high-interest rates next. Subsidized loans are better than unsubsidized loans because you dont have to pay for any interest that accrues during your enrollment plus the 6-month grace period after finishing. Because of this it may be smart to pay off your private student loans first.

For subsidized and unsubsidized federal student loans the fee which is charged to the aggregate total is 1057 for loans disbursed after. It accrues interest at 528. With unsubsidized and subsidized loans you could follow the same snowball or avalanche approach.

If youre also receiving an unsubsidized student loan the total cant exceed 5500. The only similarity in payment details for the loans is the origination fee at 1059. Not quite sure how that works wondering if it mattered.

However youll want to pay down the principal of subsidized loans with high interest rates to avoid future growth. Immediately the unsubsidized loan is disbursed to you. But similar to subsidized loans you dont have to start paying off unsubsidized loans until after your grace period ends.

The subsidized loan limit for your entire undergraduate. Unsubsidized loans on the other hand start gathering interest as soon as you borrow them. An alternative private loan can be an effective way to bridge the gap to cover the cost of attendance for college.

You may need a little extra if youre on your own. Thus subsidized loans are not accruing interest while youre in school. Subsidized loans offer many benefits if you qualify for them.

For example a first-year dependent undergraduate student can borrow 3500 in subsidized loans compared with 5500 in unsubsidized loans. How much interest youre charged and how it accrues over time plays an important role in prioritizing which student loans to pay off. The NC Assist Loan is serviced by College Foundation Inc your state-based nonprofit lender.

Start With Your Unsubsidized Loans.

Subsidized Versus Unsubsidized Student Loans Explained Simply The Motley Fool

Federal Student Aid Sur Twitter Thanks To Everyone Who Replied The Correct Answer Is False You Are Responsible For Paying The Interest On A Direct Unsubsidized Loan During All Periods Learn

Which Loan Should You Pay Off First The Common Cents Club

Subsidized Vs Unsubsidized Student Loans Know The Difference

0 Comments